If your finances are giving you a headache but you feel like you can’t afford to buy aspirin, don’t panic! Take your time and peruse this article to find out much of what you need to know. Once you gather the right financial knowledge, you can greatly improve your situation.

Be positive that you can truly trust the person that you are entrusting your life savings with. Check their references and listen to what they say to judge their honesty. Tailor your broker choice to your experience level, as well.

You may not know it, but when you pay full price, you are paying too much. Saving with coupons should be more important to you than brand loyalty. If you usually buy one brand of dish soap and can save money with a coupon on another brand, go with the one that is cheaper.

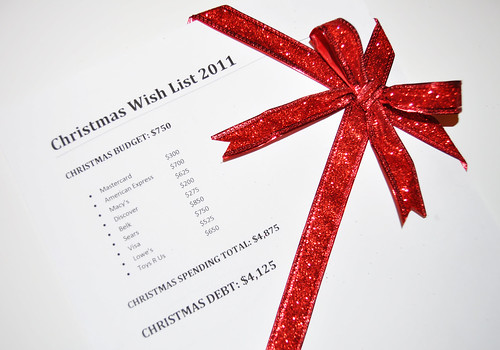

Try to avoid debt whenever possible to have better personal finance. Some debt is unavoidable; however, if you can avoid those sources of debt that are problematic, like credit cards, you will save yourself headaches later. If you borrow as little as possible, you can avoid paying costly interest charges.

Use two to four credit cards to enjoy a satisfactory credit report. Using only one card means it will take a long time to build a good credit score, and more than four cards means you cannot manage your finances efficiently. Start off with just two different credit accounts and add new ones if and when necessary.

Things can appear to get worse before they get better, with your credit rating actually dropping in the beginning of the credit repair process. Don’t worry, though, you haven’t done anything wrong. Your credit score will improve as you take steps to improve your record of payment for your debts.

Do not put any more charges on your card if you are experiencing a hard time paying it off. If you cannot find a different way to pay for expenses, at least try to reduce the amount that you charge to the card. Pay down the complete monthly balance before making future purchases with the card.

By having a savings account that you deposit into regularly, you will be building financial stability. Socking away money in advance means you have to rely less on credit when disaster strikes. Even if you can’t deposit a lot, you should still save up what you can.

Do you use air travel a lot? If so, it may pay off to sign up with an airline’s frequent flier program. Credit card providers give out rewards for purchases that you make. Many frequent flier programs allow you to redeem miles for reduced rate motel stays.

To keep your finances in check it is important to avoid going into to debt with credit cards. Really consider any purchase you are about to make on your credit card. Carefully consider how much time paying it off will take. Unless it’s an essential item, don’t buy more on credit than you can afford to pay off at the end of the month.

Now that you are aware of how finances work, you should have a lot less stress. Keep in mind all the points covered in the preceding paragraphs, plus keep learning how you can improve your financial picture in the future. This is a start to a whole new life, one that includes not being in debt, and saving money! Have fun!